“We had to decide whether to bring this in-house so, we created a model internally, on Azure Machine Learning, which outperformed the third-party product. “We were using a third-party, specialist machine-learning fraud-detection platform to help us spot fraudulent sign-ups to Noddle,” said Mark Davison, Callcredit’s chief data officer. Callcredit is using Azure Machine Learning which uses existing data to verify the identities of those signing up to Noddle.

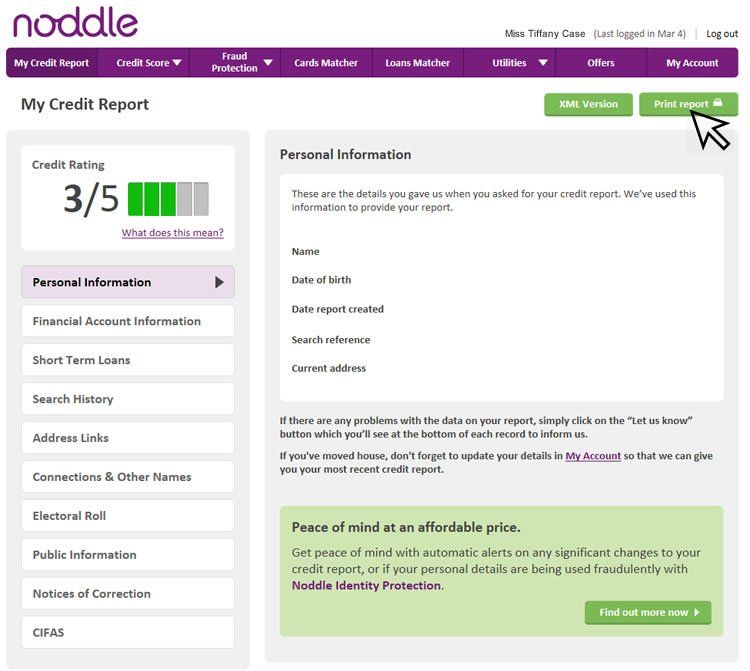

Noddle is a free-for-life credit report and score service that searches the market to find credit cards and loans available to a person based on their credit rating.

The services have successfully stopped fraudulent access to Callcredit’s credit reporting and scoring service Noddle, and prevented consumers having loans taken out in their name. Callcredit, one of the UK’s biggest credit reference agencies, is using Azure Machine Learning to identify criminals assuming a different identity when trying to access credit reports and borrow money.

0 kommentar(er)

0 kommentar(er)